A sample of recent coverage

The power of GRCStratMaps.ai

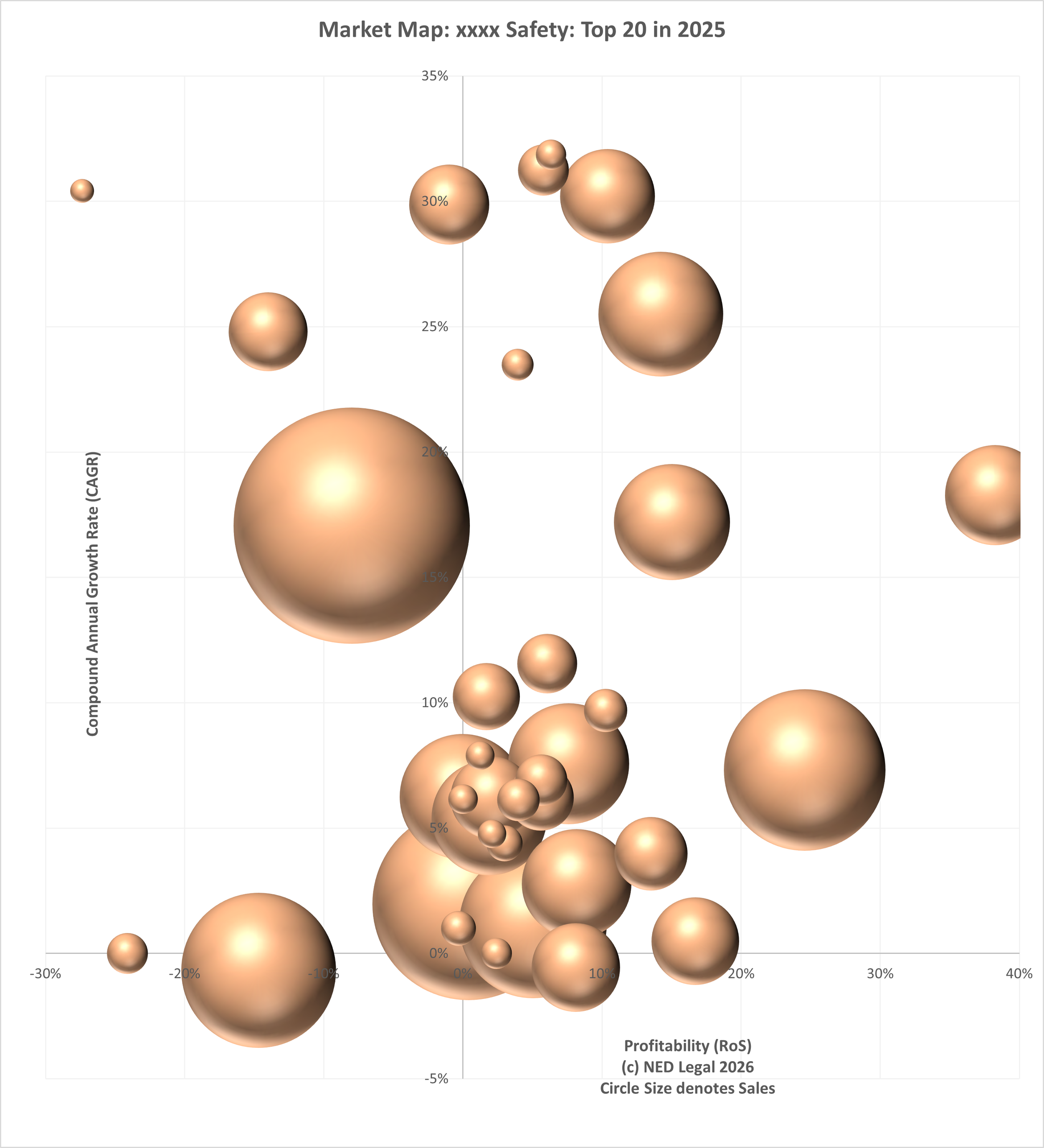

Can you tell which market sector this is?

Can you see what lessons there are for leading brands?

How about disruptors and their timings/potential?

Long term financial metrics show financial character.

There’s always a scrum - but how do you get out of/ahead of it?

The map shows ‘heat’ in the sector, but also which firms are sharetakers, caretakers or painstakers.

Leadership transitions

The founders’ nightmare is that when they hand over the reins, as inevitably they must at some stage, the business actually improves. Entrepreneurial vision is best described as an implacable belief in the improbable, and their choice of clients, staff, and tactics sets the tone. There are three examples of founders in transition below: PHSC has swapped out both of its founders, Pennington Choices had an unsuccessful ‘partial mbo’ before selling to Mears, and C&G training has seen a revival in fortunes under an internally promoted MD. Such transitions are always complex and speak directly to enterprise values, but market context matters too. PHSC has consistently underperformed one of the strongest GRC markets; to use a rugby analogy, Pennington Choices ‘knocked the ball on’ within sight of the line and recovered; and C&G may just have proven that the long game in training is still a sweet spot all of its own…

It’s all change at PHSC, the AIM-listed safety group. And not before time. We don’t do listed firm investment advice, and the share price is not the issue here. Frankly, the business should never have listed in the first place, needs to cut its overheads and refocus. A market cap below £1m and a new CEO not from the hallowed halls of other listed firms means the shares may continue to struggle. Perhaps the new leadership will grasp this nettle, but to date all that PHSC have demonstrated is that listed markets are a lousy way to raise cash. In fairness, they have outlasted some other listed GRC car crashes, but the experience of the markets with GRC teams is not a good one, and that’s a world where reputation matters.

So what? Well it makes IPOs a less attractive option for future PE exits, but that’s another story. In theory, PHSC has all the right components…

BSA &ERB

It’s often unfair to say a firm is ‘dressed’ for sale. It’s easy to spot usually; for seasoned heads at least. Major swings in headcount/wages are the simplest clues. The simplest way to boost profits is to stop recruiting key account sales people, for example, or to ramp up caseloads on consultants. Two recent deals demonstrate the opposite of this. Ark/Helix has boosted staff, tidied up its intra-group accounts significantly, and clearly learned some hard lessons from assorted flirtations over the years. Ditto, a smaller HR team snapped up by Omny. Both are being driven by the red tape surge that is the Building Safety Act and the coming HR equivalent in the Employment Rights Bill. Both take careful timing on exits for founders. Cash is still choosy in M&A right now, but available; there are a lot of people fishing without hooks as they learn the lie of the land; but it’s there. The real pressure points right now, though, are experienced staff salaries in both safety specialisms and HR ones.

A private equity team taking on ArkWorkplace and associated companies in Helix International is hardly a surprise. The real surprise here is the choice of Queen’s Park Equity (QPE), a small comparatively new PE team as the backer. QPE has raised two funds in the past 5 years and in combination is c£500m AUM. Their fund that took on Helix closed at £202m in 2020 and this is their 13th deal. So what? Well, it will not be a bleeding edge headline cash figure, but more likely a highly structured deal with ‘sweet equity’ for the exiting founder in managed funds and forward looking incentives for the mbo team.

Another half billion PE team makes no real difference to the GRC services market, but during Duras’ rise to CEO there has been a lot of tidying up (c£11m) of the intra-group funding and relationships. A solid background in freight forwarding for Duras helps as the world-class account management skill set clearly fits Ark’s strategy. QPE exited their Encore Estate Management holding a while back and this was a similar sized business to Helix, so in effect they’ve swapped a property management holding for a compliance one. They paid x12 for the Encore £10m/£1.5 business. Within 3 years they had doubled sales and trebled profits; impressive. No doubt they aim to achieve something similar with Helix, which means they’ll be incentivising the mbo team to deliver …

★★★★★